An interview with David Castaneira – Country Manager, TechTarget France

In this 2016 Market Spotlight series we’ll be giving in-depth interviews with regional marketers on the current state of B2B technology marketing in countries around the world. This series is meant to provide regional background understanding of unfamiliar markets that you, as a marketer, might be purchasing or working within.

In today’s blog we’ll be talking with David Castaneira, the country manager for TechTarget France. David has been working in B2B Technology Media for 18 years including work as an online journalist and online editor-in-chief of a news website on IT for the French subsidiary of a large international media group. In 2004, he started to enlarge his role to online marketing and business development, finally helping launch the website LeMagIT.fr in 2008. “I thought that information for IT Decision Makers (ITDMs) needed to be more in-depth with value and context to the content as well as lead to ROI and demand generation which was very much lacking in France at the time.” In 2010, LeMagIT.fr became an exclusive partner of TechTarget and became a fully integrated part of the portfolio and its acquisition in 2013 led to the launch of TechTarget France.

Can you give us a sense of the current market landscape? What is going on today in the market?

On a global perspective, France will have better economical results soon as the last economical turnover [in 2008] hurt the country and caused some change to the law to help developing businesses. These changes will help France come back faster from economic failings.

On an IT investment perspective, 2016 shows that more than 70% of the ITDMs will get the same or more budget. In France, we used to have longer IT product lifecycles; however, due to digital transformation, cloud computing, mobility and Big Data, infrastructure investment should be massive in the upcoming quarters.

On a media perspective, marketers, vendors and agencies are looking for the best way to understand the customer journey, get trackable ROI, and use data to nurture their CRM or customer strategy. For the moment, the offer is more on reaching a larger audience, branding, without too much emphasis on data, tracking or targeting. However, as marketers become more and more ROI and business development oriented they need to run more targeted and intelligent programs to understand the customer journey and be considered.

How has French publishing changed over the last 5 years?

Online has changed the publisher landscape, especially in B2B. The way publishers used to develop their audience was to get mass volume versus building engagement. That meant more news, superficial coverage, heavily product-oriented, and a B2B/B2C mix. Also, most of the publishers in France have a refresh tag on their site [page automatically refreshes to a new page view without user initiation]. Initially, it was to accelerate the news delivery but now it’s more to optimize and keep the look of a larger audience. This is exactly the opposite direction we chose to take a few years ago on LeMagIT.

Who are the current publishers in the market? How has this changed?

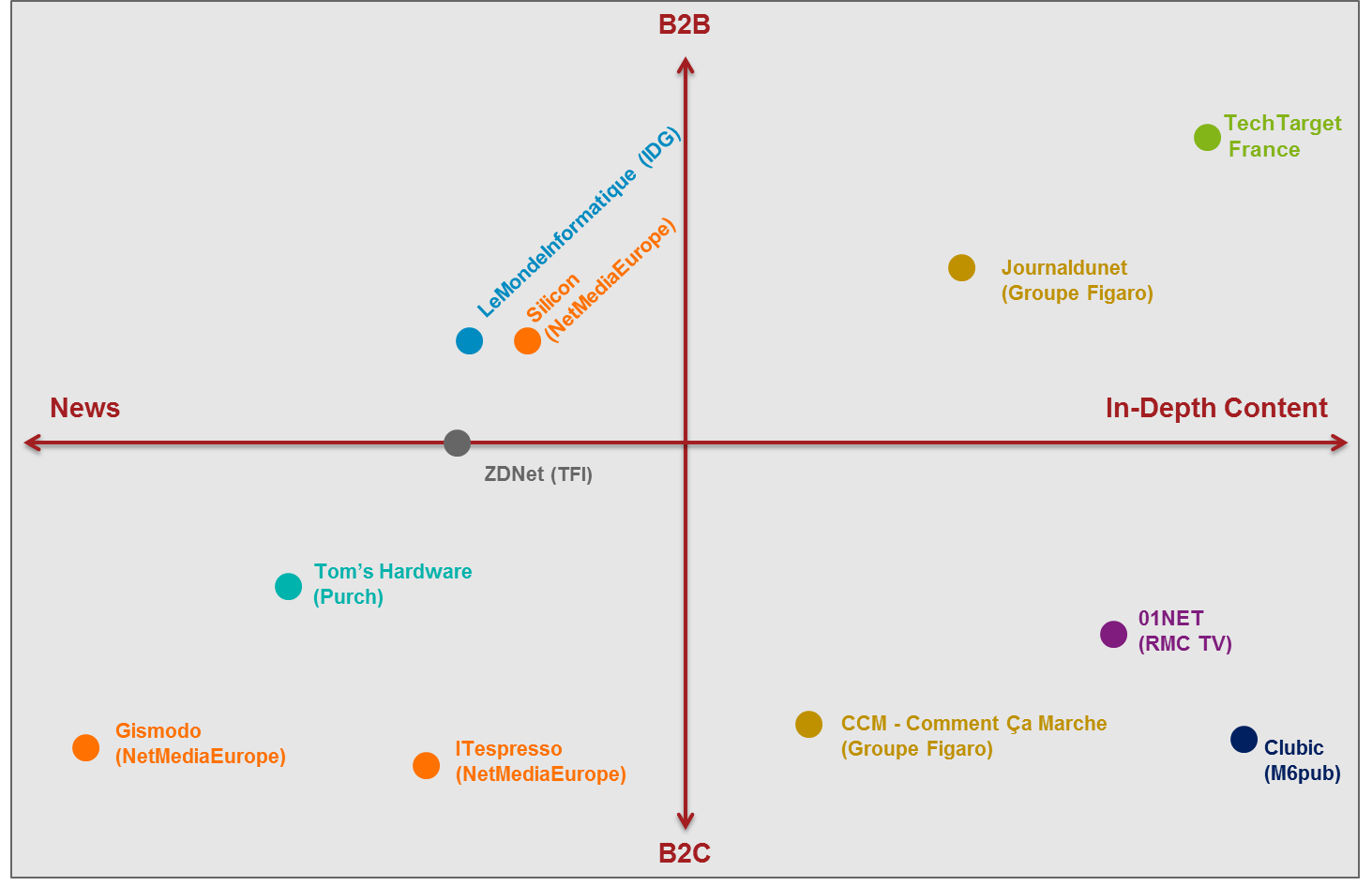

Historically Groupe Tests was the leader. But they are 100% focused on B2C now. B2B is covered mostly by Print. IDG is no longer directly in France and their work with Le Monde Informatique [the website] is 50% B2B and 50% B2C. Essentially, they give news and product reviews. ZDNet works the same way. Silicon is more B2B but are mainly news oriented. Others exists but they are not part of large IT media groups, focusing instead on branding and news. This quadrant maps out media options for B2B IT marketers targeting France.

How does French culture affect marketing spend?

IT companies in France are mainly US companies. Locally the main issue is to adapt culturally relevant practices and in-language content. In-region marketing spend has to show ROI with a high content cost [as you have to translate or produce locally]. It means that marketers are interested in online marketing as the best way to understand customer journey and get the type of customer data to refine tactics and strategy – ROI and content management are complex. Custom products are popular as they support content production effort and could give branding results too.

However, more than marketing, the culture difference is at the sales level. Sales teams are very close to customers and love to be in contact, based on their own knowledge. They prefer Physical Events as the main marketing support. The point to remember is about ROI : events are costly and mainly address well-known clients. Telemarketing is popular too in this same sense, especially to feed the channel.

Online marketing is now starting to be successful in affecting the way sales works to help develop new business and work on the customer journey to optimize their customers’ relationship.

Have the latest threats to the market changed B2B IT buying for 2016 at all?

French market is recovering now after years of global downturn and very slow growth. IT investment though in French companies – specifically international ones – has to be competitive regarding digital transformation. And some of them are late on infrastructure move. This reality, the global market recovery and lifecycle momentum linked to Windows Server and SQL update will drive IT expenses for at least a year.

What are the current IT Priorities in the market?

We survey our audience frequently to understand the trends and priorities related to IT spending and strategy. Based on insight and results from these efforts, these are the top organizational priorities in the French IT market:

- Mobility

- Cloud computing and infrastructure optimization

- Big data

The French were late due to cultural and security confidence as well the lifecycle in infrastructure is longer in France than its western counterparts in the UK and Germany. In 2016/2017 companies, will invest more and more on mobility tools – specifically to implement corporate-issued mobile device programs or deploy mobility administration tools or enterprise application.

For Cloud, 2016 will be a year of change. For the first time, cloud computing is the first area to increase in budget. Private cloud as well as hybrid infrastructure or public cloud will be on the plan. In storage, for example, 25% of initiatives will be around cloud computing. Optimizing Data Center and infrastructure for lower cost and better performance is also a priority.

Big Data and data management are also areas where French organizations will invest. Collaboration and mobility development will fuel a big volume of data. Organizations want to invest in BI, data visualization, data quality tools, big data processing and management or SGBD (relational or In Memory) to address specially this challenge.

Finally, an up-and-coming market trend is Internet of Things (IoT) – France will be an early adopter and began to take initiatives in this area in 2016.

We would like to hear from you on what you are focused on related to the French market in 2016. If you would like to continue the conversation around French market initiatives and strategy, feel free to leave a comment below or connect with me on LinkedIn.